Your Path to Financial Freedom

Introducing our Solar Wealth Plan:

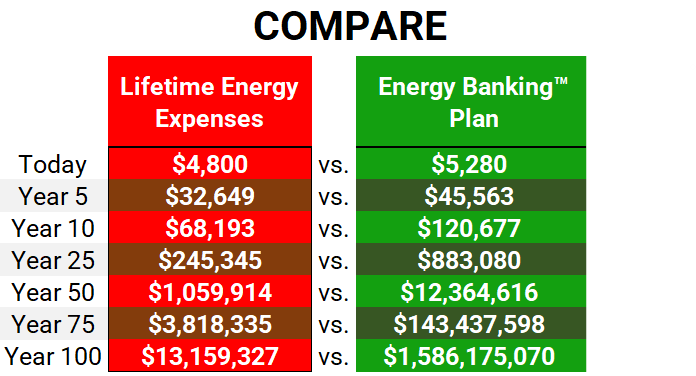

“Our innovative plan estimates your lifetime energy expenses and

compares them to the potential returns from investing your monthly solar savings.”

- Maximize Your Solar Investment

- Energy Banking: A Path to Financial Freedom

- Solar Tax Optimization: Claim Your Maximum Benefits

- Tailored Solar Solutions: Design Your Dream Roof

- Comprehensive Energy Consulting: Expert Guidance

- Uninterrupted Power: Backup Solar Options

Financial Assumptions Energy Expenses:

- Monthly Energy Costs: $200 (Electricity)

- $200 (Auto Fuel)

- $400 (Combined Utility Costs)

- Inflation Rate: 5% per year

Energy Banking Plan: - Investment Rate: 10% per year on monthly energy bill savings

Tailor Your Solar Journey Create a Personalized Plan

“At Solar Tax Advisor, we provide transparent and comprehensive information about solar energy. Our expertise in maximizing solar incentives allows us to offer unbeatable solar proposals tailored to your specific needs. We collaborate with the country’s top-tier solar installers to ensure a smooth and hassle-free installation process.”

FREQUENTLY ASKED QUESTIONS!

What Are Solar Incentives?

Beyond the 30% federal tax credit, there are additional state, local, and utility incentives available. Our Solar Tax Plan helps you uncover and claim these hidden benefits.

How Does the 30% Investment Tax Credit (ITC) Work?

The 30% ITC is a non-refundable credit, meaning you only receive a refund if you pay income taxes. The amount you receive depends on your income tax liability.

- Carry Forward: Unused credits can be carried forward for 20 years.

- Higher Income Taxpayers: May receive a larger refund in the first year.

- Lower Income Taxpayers: May receive a smaller refund initially but can carry forward more credits.

- No-Income Taxpayers: Will not receive a refund but can carry forward the full credit.

When Can I Apply the 30% Investment Tax Credit?

Generally, the 30% ITC can be applied once your solar system is fully functional and producing energy. However, with Solar Tax, you may be able to apply it in the year the solar contract is signed if 5% of the solar project is initiated (e.g., site survey).

Can You Help Me with a New Solar Proposal?

Yes, we have a network of solar installers and professionals who work with Solar Tax Advisor clients.